The Minnesota Wild just made a major investment in their future. In the most expensive move of his offseason, Bill Guerin signed defenseman Brock Faber to an eight-year, $8.5 million per year contract. And they signed it a year before Faber’s current deal expired.

This move is like paying off a mortgage or student loans for an NHL franchise. Minnesota won’t have as much flexibility or cash on hand for the next few years, but they’ll probably come out ahead over the lifetime of the investment. Without that flexibility, the team might miss out on a better investment, but they’ve taken care of a payment they had to make eventually.

Now, the big question is this: Can Brock Faber pay off the value of this contract? Did the Wild get a good deal?

That’s a complicated question for many reasons. Assigning a dollar value to a hockey player is extremely complicated. The Wild also own exclusive rights to sign Faber for the first five years of this extension, which gives them a great deal of leverage. That means we should expect Faber’s cap hit to come out lower than his on-ice value. But how much of a discount could the front office expect with this leverage?

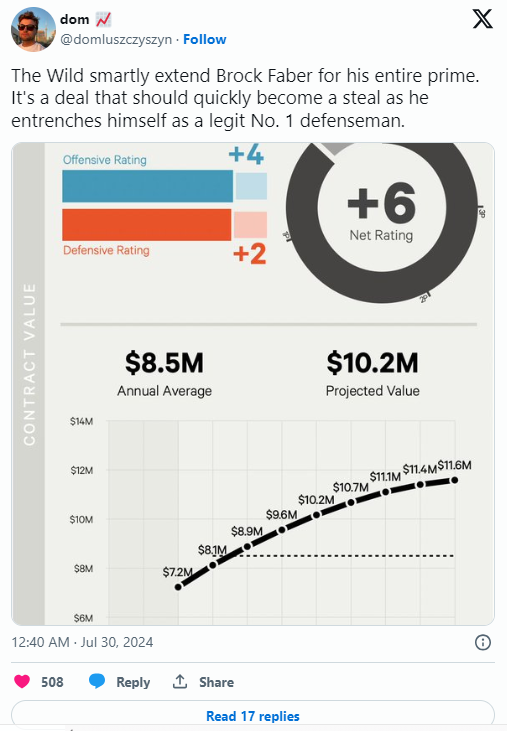

Let’s address the hard numbers first. According to The Athletic’s analytical model, Faber will likely produce more on-ice value than the cap hit over the contract lifetime.

That gives a good baseline, but theory will take you only so far. Hockey is a team game, so measuring on-ice impact is difficult, especially with only one season of data. Even the most enthusiastic stat-heads prefer to work with at least two seasons of data, and ideally three. Furthermore, the numbers in this model only show what Faber has done in the past. Projecting into the future adds another degree of uncertainty.

Understanding the context around Faber’s numbers can reduce that statistical uncertainty, although it introduces some level of human bias. Still, it helps to consider who Faber played with (both opponents and teammates). The model attempts to account for the quality of teammates and opponents, but it’s still important to contextualize Faber’s role.

Per Natural Stat Trick, Faber spent most of his five-on-five minutes next to Jake Middleton (802 min) and Jonas Brodin (561). Middleton and Brodin are conservative in the offensive zone, which gave Faber license to jump into the offensive play. He also spent more time with Kirill Kaprizov (526), Joel Eriksson Ek (484), and Matt Boldy (481) than any other player.

So, that tells us the Wild expected Faber to bolster the top line’s scoring. Interestingly, this group of six players had a very definite role according to Dom Luszczyszyn’s model. Evason and Hynes used them to attack their opponent’s best offensive weapons. It was a difficult defensive assignment, but if they could win back the puck, there would be scoring opportunities (partly since they all played with Kaprizov).

Faber’s role was to cover Kaprizov defensively, allowing the sniper to take more risks. Faber could chip in on offense since he always had Brodin and Middleton ready to backcheck. Based on their competition, this was a fairly demanding role and a perfect role for a modern top-pair defenseman. But with the support around him, it wasn’t as demanding of a role as might be expected of a team’s No. 1 defenseman.

Based on this role and his analytical production, it would be entirely fair to say Faber’s 2023-24 season turned in top-pairing quality play. At age 21 and in his rookie season, that’s an encouraging performance. Even if he regresses from that level in the short term, he should continue to improve and eventually outperform that as his contract extension ages.

So, is that enough?

The short answer is “yes.” If Brock Faber’s floor is top-pairing defense, that’s still break-even value by Luszczyszyn’s model. If Faber turns into a true No. 1 defenseman (top 15 in the NHL), the deal will be one of the best contracts in the league.

So let’s work off that number in the middle, based on the Athletic’s projection for Faber’s value throughout his career. It’s as good a guess as any publicly available number into how much value the deal adds to the Wild roster.

By this estimate, Faber gave up about $13 million to lock in eight years of NHL employment and salary. He also gave up three years of unrestricted free agency in his age-28, age-29, and age-30 seasons. Those are typically very fat years for an NHL defenseman. In return, he essentially insures himself against the chance of a major regression in 2024-25 or a career-altering injury.

That’s undeniably a good deal for Faber, given that he can only talk to Minnesota for the next five years. Given that leverage, is this optimal value for Minnesota? Analyzing leverage can be tricky, so contract comparables are one of the best ways to break that down. Usually, these deals for young players are rare, but Guerin has signed two in recent years: Boldy and Kaprizov.

Both players had played one season for the Wild, just like Faber. COVID had shortened Kaprizov’s to just 55 games, and Boldy split his 89 games between 2021-22 and 2022-23. At the time of his signing, Kaprizov’s deal presented a surplus value (team-friendly due to leverage) of about $16.5 million over four years. Boldy’s rounded out Luszczyszyn’s top-10 contracts in hockey with a whopping surplus of $3.2 million this year and a projection of $24 million in the next six years.

Of these deals, Kaprizov’s is probably the most player-friendly. While he was underpaid by $3 million more than Faber, he got out from under that and went into free agency sooner. He’ll be 29 in his first UFA season, and Faber will be 30. Kaprizov will also have fewer years of NHL wear-and-tear on his body and will be significantly overpaid as a superstar forward. That’s how NHL free agency works. Faber’s deal is probably more team-friendly since the Wild get more years of cheap play from Faber than from Kaprizov.

On the other hand, Boldy’s deal is so team-friendly that it looks like Guerin’s best-case scenario for the Faber extension. Boldy signed away his prime years just like Faber but at a much steeper discount. Taken together, the extensions for Kaprizov and Boldy make Faber’s look totally fair.

Ultimately, this is another excellent bet by the Wild GM. It’s a fair market value for the Wild in exchange for the lengthy term and the flexibility they gave up with that term. Furthermore, the two sides met at a number that’s in line with his projected value over the life of that contract in light of that leverage.

The only remaining wrinkle is that it’s tough to reliably project a player’s career off of any one season of data, let alone their rookie year. Fortunately, this contract leaves room for Faber to underperform or overperform the number by a great deal without becoming a total rip-off for either party.

Faber gets his generational wealth, and he’ll likely outplay the value of this extension. The only way he can’t is for his rookie year to be the best season of his life. The interesting thing about the NHL is that they don’t usually let a rookie defenseman luck into a top-pair-quality season. They normally attack them, and Faber held his own.

Nobody will know how good this contract is until Faber plays one or two more years in the NHL. By then, there won’t be much to do about it. For now, call it a win for both sides and enjoy eight more years of Brock Faber in Forest Green.